L&I proposes 4.9% average increase in workers’ comp rate for 2026

The Washington State Department of Labor & Industries (L&I) is proposing a 4.9 percent rise in the average hourly rate employers and workers pay for workers’ compensation insurance in 2026.

The increase would help pay for the rising cost of providing benefits when a worker is injured on the job. The proposed increase is less than what L&I expects to need to cover 2026 claim costs. As it has done in past years, the agency plans to use the workers’ compensation contingency reserve to cover the difference.

If adopted, the increase would raise the cost of coverage by about $1.37 a week per full-time employee, on average. Employers and workers will both contribute to pay for that increase.

Employers and workers pay into the workers' compensation system to help cover the cost of providing wage and disability benefits for injured workers, as well as medical treatment of workplace injuries and illnesses.

Each fall, L&I determines the proposed workers' compensation rates for the following year by looking closely at several factors, including the expected workers' compensation payouts, the size of the contingency reserve, wage inflation and other financial indicators.

Questions about the Proposed 2026 Premium Rate

- The accident rate which pays for wage replacement benefits and disability awards.

- The medical aid rate which pays for medical care and vocational services.

- The supplemental pension rate which pays for cost-of-living adjustments for long-term time-loss and pension recipients.

- Finally, the Stay at Work rate which pays for employer financial incentives to keep workers on light-duty jobs while they heal.

- Assessed over $118.2 million in unpaid employer premiums, penalties, and interest.

- Collected a total of $372.7 million in delinquent money, of which $350.2 million came from unpaid employer premiums.

- Audited over 1,350 employers, of which over 570 were unregistered.

- Received nearly 2,300 employer fraud leads.

- Completed 89 worker investigations of fraudulently claimed workers’ compensation benefits, amounting to about $11.7 million in cost savings.

L&I attributes the proposed increase to several factors, including wages. L&I will tap its contingency reserve to augment the proposed increase. Workers and employers focusing on safety, and L&I initiatives that are helping injured workers recover and reducing workers' compensation costs are helping keep the proposed increase to a minimum.

COVID-19 claims incurred during the health emergency do not impact the workers’ compensation rates, but COVID-19 claims incurred after the health emergency are included in the rates.

Early in the pandemic, the agency decided that COVID-19 claims would not affect employers’ future rates while under a state of emergency. The COVID-19 emergency was lifted July 1, 2023, and the costs for COVID-19 claims with a date of injury or exposure on or after that date will be included in the rate calculations starting with the 2026 rates.

The proposed 4.9% increase is an average. Individual employers may see their rates go up or down, depending on their recent claims history and changes in the frequency and cost of claims in their industry risk classification. Those changes also can increase or lower premiums paid by workers because workers in Washington pay a portion of the total premium. Go to Lni.wa.gov/WorkersCompRates to see the proposed changes for all risk classes.

The proposed 2026 increase will cost employers and workers an average of about $71 a year per full time employee (about $68 per full time employee after retro refunds).

Workers pay on average about 24% (26%, if considering retro refunds, which reduce employer premiums) of the premium, and they would pay about the same share if the proposed rates are adopted. The actual percentage depends on the classification of the worker's company and its recent claims history. Washington is the only state where workers pay a significant portion of the premium.

The total rate is made up of four rates that provide benefits when workers are hurt on the job:

Workers and employers each contribute one-half of the medical aid, Stay at Work Program and supplemental pension premiums. Employers pay for all the accident premiums.

Out of the state's 327 risk classes, 293 will have higher base rates in 2026 if the proposed changes are adopted.

Risk is pooled across all of the risk classifications, which helps keep premiums stable for all while helping those who have had a tough year. So even if a business has an excellent safety and return-to-work program with no injury claims counting against their experience factor, their rate could go up if the rate for the risk class is increasing.

Maintaining a safe work environment and helping injured workers heal and return to work quickly and safely does have a return on investment. When costs are lower across a risk class, all employers in the class benefit.

Yes. L&I offers employers a Claim-Free Discount for employers that can lower their average base rate by 10% or more. Learn more at Lni.wa.gov/ClaimFreeDiscount.

As rates are based on the risk classifications assigned and your experience factor, you can help manage your insurance claim costs which in turn may affect the experience factor. Visit Lni.wa.gov/ControlMyRates for a list of resources that L&I offers to help employers control premium costs.

In times of need, L&I's Employer Assistance Program allows an employer with a good payment history to ask for a 90-day "same as cash" payment plan, with no interest or penalties. Learn more and find out if you qualify at Lni.wa.gov/EmployerAssistanceProgram.

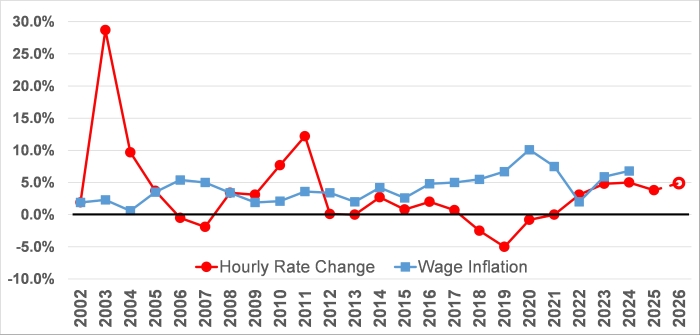

The chart below shows the changes in rates (circles) and wage inflation (squares) over the past two decades. L&I's goal is to use wage inflation as a benchmark for steady and predictable rates. Wage inflation is a good benchmark because workers' comp costs increase as wages increase.

Washington's current system, which charges premiums based on the worker's exposure to the risk of injury (hours worked), was established many years ago. This system doesn't negatively impact employers who pay higher wages.

In most states, rates are charged as a percentage of payroll, so when employee wages go up, more premium is collected. In Washington, rates are charged as an amount per hour. When wages go up, the rate paid stays the same.

If the proposed rate increase is adopted, the average rate per $100 of payroll in 2026 will be $1.50 before retro refunds, about what it was in 2022. Workers will continue to pay on average about a quarter of the premium, a similar percentage to that paid in 2022.

The accident, medical aid, and pension funds have enough financial assets to cover the expected benefits that will be paid over the long term to workers who have already been injured.

Consistent with insurance principles, L&I also tries to keep additional assets (contingency reserve) above the amount of these liabilities in order to cover unexpected future events that will likely occur. Unexpected events include downturns in the economy that may affect fund investments and opportunities for workers to return to work, court decisions that may increase future benefits, or natural disasters that affect workplaces.

L&I keeps a lower contingency reserve than other workers' compensation insurers, including other state workers' compensation funds. The private insurance industry and other state funds have, on average, a surplus of between 50% and 60% above their liabilities.

In recent years, L&I has been providing vocational support and assistance much earlier in claims. It's helping reduce long-term disability and improving return-to-work results for those hurt on the job. The agency's Stay-at-Work Program is also making a difference, providing employers more than $179 million to help keep more than 68,000 workers on light duty while they healed.

L&I has several initiatives underway that are lowering costs by focusing on better outcomes for injured workers. Some examples include promoting workplace safety, ensuring injured workers receive quality health care, providing vocational services to workers and supporting employers who want to keep injured workers on a job.

Expenses associated with long-term disabilities and fatalities make up the majority of costs covered by premiums in the workers' comp system. The best way to control costs is by creating safe workplaces to avoid injuries, illness or death.

Inspection and consultation activities by L&I's Division of Occupational Safety and Health (DOSH) make a significant contribution to reducing claim rates and costs. Studies show that employers receiving a safety inspection or safety consultation have 10 – 30% fewer claims filed by their workers.

L&I makes employers, workers, and health care providers think twice about committing fraud. The program uses systematic and innovative approaches to detect and deter fraud and abuse.

Last fiscal year (2025), L&I:

To learn more or to report fraud, visit Lni.wa.gov/Fraud.

Learn more

- Look up Proposed 2026 rates by risk classification

- NEWS RELEASE: Proposed 2026 workers’ comp rate increase would help pay for rising cost of coverage

Other resources

- Lni.wa.gov/ControlMyRates: Ways you can keep your premium costs low.

- Lni.wa.gov/ClaimFreeDiscount: Learn how to earn and keep the discount.

- Video: L&I Rate Setting 101: Shows how L&I crunches the number to calculate your rate.

- Stay at Work: It's a Win-Win: Learn how the Stay at Work Program saves costs.